The Reasons Why Nike Are Struggling Right Now

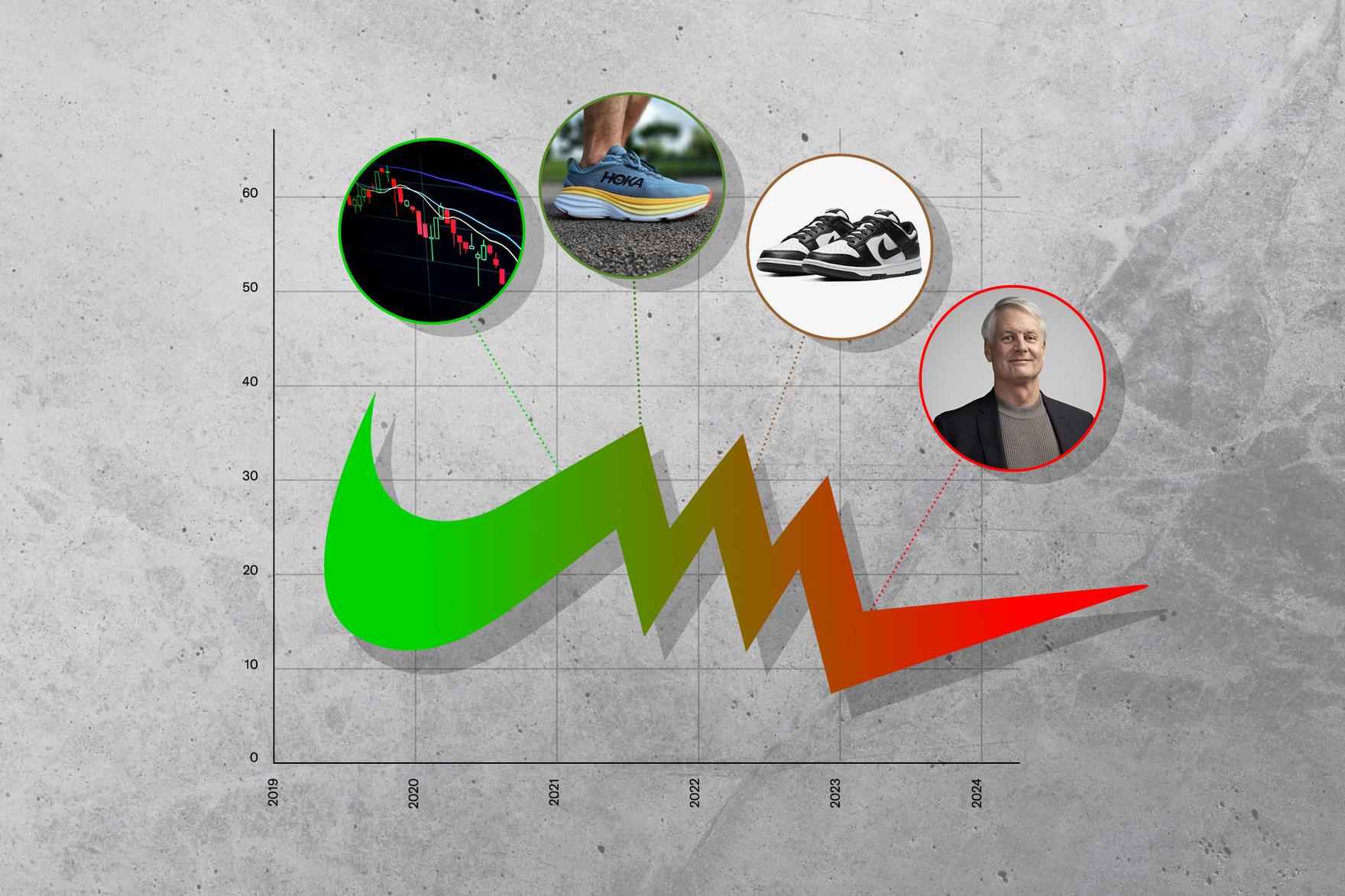

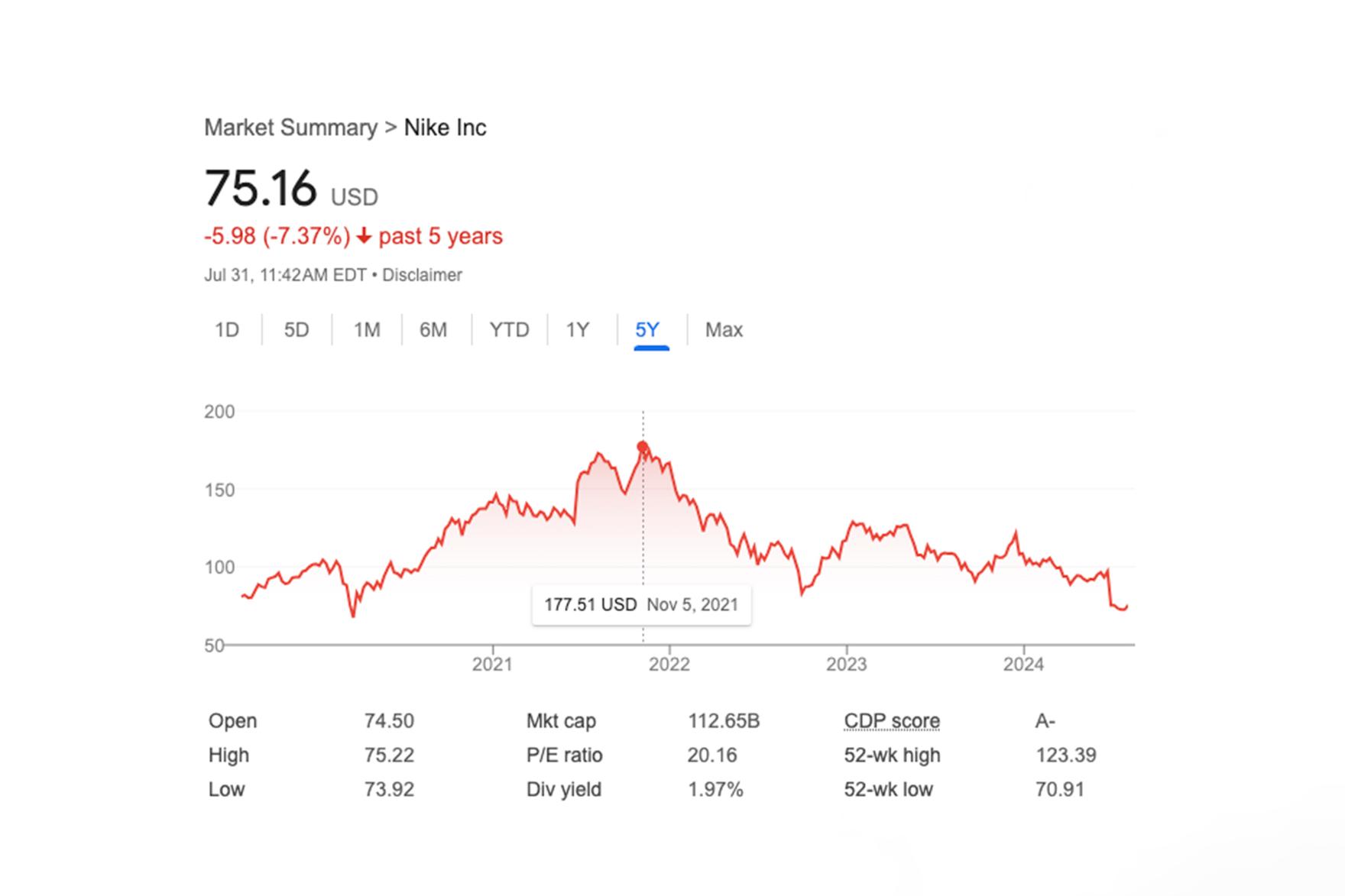

June 28, 2024 is a day many employees and shareholders won’t soon forget. It’s when their stock value fell 21 per cent, making it the single worst trading day in the company’s history. This plunge came after Nike released their fiscal fourth quarter 2024 results a day earlier, where the brand announced Q4 revenues were down two per cent and they also expected fiscal Q1 2025 revenue to be down in the double digits at approximately 10 per cent.

Finance experts everywhere wasted no time explaining and speculating what led to the decline of Nike’s revenue, blaming it on factors including Nike CEO John Donahoe’s leadership decisions and the brand’s lack of innovation in recent years. There are countless articles written from a financial perspective with loads of numbers and technical terms, which is all well and good, but this piece presents what happened from a sneakerhead’s point of view. We can’t tell you if you should buy, sell, or hold on to Nike stock, but we can tell you why the brand are in the current commercial quagmire and what the path forward might look like.

Was Nike’s Stock Overvalued in the First Place?

In 2021, Nike stock reached its all-time peak at over $170 a share, but it may have never actually been worth that much. Some financial experts feel that at the time Nike’s value was overhyped and the market is just now adjusting accordingly. During the COVID-19 pandemic lockdown in 2020 when Netflix launched The Last Dance documentary about and the Chicago Bulls’ 1997 to 1998 season, sneakerheads and non-sneakerheads everywhere started going crazy for Air Jordans. Additionally, sneaker collectors will remember that 2021 was the height of Nike cashing in on the hype surrounding the . So between those two factors, the brand was practically printing money with every restock of the ‘Panda’ Dunk and new colourway of the , and there were plenty of other big releases like the along with big-name colabs by , , and more. 2020 and 2021 were also the years when everybody had extra free time to get into running and other forms of fitness, so more Nike performance footwear and apparel were being sold.

Three years later, the Dunk has cooled off significantly, people are getting tired of the incrementally different Air Jordan retro colourways, and everybody is back to work, which means Nike are selling much fewer running shorts, yoga pants and Air Jordan 1s. The market has shifted, and Nike’s stock is now closer to where it was before the pandemic.

More Competition: Nike Are Losing Market Share to Other Brands

The pandemic fitness boom helped Nike sell more running shoes, but it also gave smaller, upstart brands like and more time to shine and increase in popularity, especially for those looking for something new and different. The result was that On and Hoka, and fitness apparel brands like Lululemon (who recently increased revenue 16 per cent YOY), took away a substantial portion of Nike’s market share.

In the lifestyle category, we all definitely got tired of the many Dunks, and Air Jordan 1s that Nike rolled out incessantly, and just like with running, sneaker consumers began to turn to other brands and models like the , New Balance 550 and even for their basic daily pairs. Elsewhere, the Y2K fashion trend helped brands like and New Balance distract sneaker buyers with their flashy retro runners featuring a combination of airy mesh, silver uppers and chunky soles. Think models like the and , which are two of the hottest-selling sneakers in the last two to three years.

Also, as Nike’s quality and comfort seemed to decrease on their retro-style sneakers with cheaper plastic-y leather and smaller Air bubbles, consumers began to turn to other brands. For example, New Balance with their quality ‘Made in USA’ line spearheaded by , or 's cushy runners sitting atop a cloud-like layer of foam.

If Nike want to win back customers, they’ve got to hit us with something fresh, new and innovative, which leads us to the next point…

Nike’s Recent Lack of Innovation

Nike are relying too much on selling Dunks, Air Jordan 1s and Air Force 1s, which are all relatively simple retro designs that are easy for the brand to produce and sell at high margins. Of course, all three are iconic sneakers, but enough is enough in the eyes of casual shoppers, and even many of Nike’s most loyal consumers turned to something fresh elsewhere. Nike seemed to recognise this well before their Q4 earnings report in June, when in March 2024 they that they’d be pulling back production of the to focus on pushing innovation and newness.

So, we’re all still waiting to see what the Swoosh can come up with to woo sneaker buyers back. Sorry Nike, but it’s apparently not the .

Losing Street Cred

Nike’s business model has increased the focus on direct-to-consumer retail, meaning fewer physical sneaker stores are stocked with their best product. Nike’s most hyped releases are often available only through the SNKRS app, which is frustrating for many consumers who never hit on the raffles, or who would rather have the chance to buy the sneakers in person at an actual sneaker store like the ‘good ol’ days’. You can only take so many Ls on the SNKRS app before you can easily buy a pair of New Balances instead. When everything is done online, it takes much of the community aspect out of sneakers, which has always been an important part of the culture.

More and more, sneaker culture is viewing Nike as a corporate behemoth that lacks the character, irreverence and passion for design and innovation they used to have in the past. Are Nike too big? Too serious? Too concerned with only making more money? Along with multiple in 2023 and 2024, it was recently announced that Nike’s self-lacing Adapt technology . This all seems to tell consumers, ‘we’re not interested in nurturing the culture that built us or introducing exciting new tech any more if it means we can’t make a lot of money off of it’. Perhaps it’s time for Nike to get more cooks in their Innovation Kitchen, not less.

Marketing and Release Missteps

Most marketing experts, sneaker fans and everybody in between have long considered Nike to have the best marketing in the athletic industry. In 1988, Nike launched their now-iconic ‘Just Do It’ slogan, and with Portland-based advertising agency Wieden + Kennedy taking the lead on most of their campaigns throughout the years (including ‘Just Do It’), the brand has never looked back. Well, until lately.

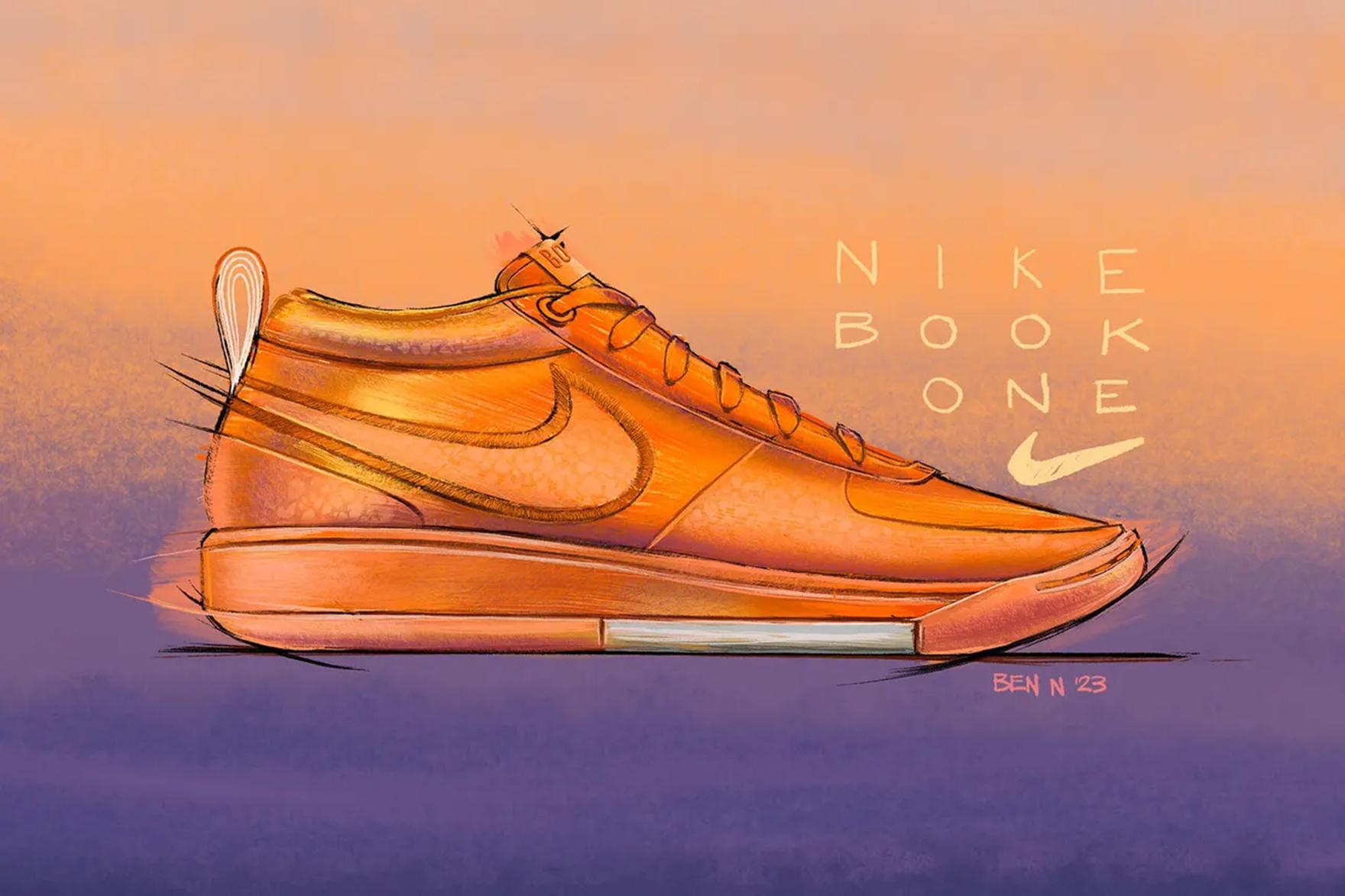

Critics are now pointing out some of Nike’s recent marketing and release missteps. Most notable of late was the rollout of the , which is the first signature shoe for Phoenix Suns star . Many sneaker collectors find the retro-inspired look of the Book 1 lacklustre in the first place, but those who actually did want to get their hands on a pair were left in confusion about when they’d be released and what colourways would be available. The story goes like this: Nike officially unveiled the Book 1 in September 2023 and then released a limited run of 500 orange suede pairs at Art Basel Miami in December, which left Booker’s fans in Phoenix frustrated that there was no local drop. Meanwhile, Booker wore a series of player-exclusive Book 1s on the court inspired by iconic Nike colourways like the and , which would never be available to the public. Or would they? Fans simply didn’t know. It wouldn’t be until roughly five months after the Book 1 was announced that most fans could get their hands on a pair when the ‘Mirage’ edition was released in February during NBA All-Star weekend.

More recently, Nike have gotten a lot of press for their ‘Winning Isn’t For Everyone’ ad campaign, with most critics being won over by the bold messaging narrated by acting-great Willem Dafoe. But one high-profile Nike athlete, , who has a lifetime contract with the brand, wasn’t so happy after being entirely left out of the commercial, and he took to social media to express his frustration. Sure, Nike can’t include all of their talented athletes, but how do you leave out KD, a three-time Olympic gold medalist?

Who’s In Charge Here?

Many analysts blame Nike’s recent financial hiccups on the company’s chief executive officer, . A former executive at eBay, Donahoe was announced as Nike CEO in January 2020, succeeding former CEO , a long-time Nike employee and designer with a passion for innovation. To put things into perspective a little more, Donahoe is only the fourth CEO ever for Nike, and only the second ‘outsider’ along with William Perez, who only lasted two years from 2004 to 2006 after taking over from the Swoosh co-founder in 1964.

Critics say performance and workplace culture at Nike have eroded since Donahoe took over. Hundreds of employees have been laid off or had their roles shifted, and Nike’s stock is down more than 25 per cent since his tenure began. Starting as the new CEO of any company right before the COVID pandemic lockdown hit would certainly have its challenges, but things still aren’t looking great for Donahoe in the eyes of financial critics.

All of the issues we’ve discussed so far that have contributed to Nike’s revenue loss like pushing direct-to-consumer retail, reliance on best-sellers instead of innovation, and marketing missteps are decisions that can be credited to the company’s top executives, meaning Donahoe has played a major part in the situation Nike find themselves in now. Knight went on in June 2024 saying that Donahoe has his ‘unwavering confidence and full support’, but you still have to imagine a CEO in this position is skating on thin ice. On August 27, 2024, published an article stating that ‘public debate surrounding John Donahoe’s future as Nike CEO is intensifying by the day’. At this point, Donahoe still has the backing of Nike’s board – which perhaps luckily for him, Knight makes any final decisions on – but according to BOF, ‘a growing number’ of investors and analysts feel that change has to happen at the top in order for Nike to fully turn their financial slump around. Time will tell if Donahoe can get Nike on the upswing, or if we may soon see a new CEO in Beaverton.

Things May Be Looking Up For Nike Already – And They Never Were That Bad

On July 22, 2024, the Monday after unveiling their gritty ‘Winning Isn’t For Everyone’ ad campaign, Nike’s stock went up three per cent. Kevin Durant may not be psyched about the commercial, but apparently, Nike’s stockholders are. Indeed, the Olympics proved to be beneficial for Nike in some capacity, whose shoes were on the feet of more medalists than any other brand when the games concluded on August 11. Nike also announced a massive for the Olympics, which created plenty of buzz in the sneaker world. Brand recognition on the world’s stage is absolutely valuable. However, analysts aren’t convinced that you should go out and grab a bunch of Nike stock just yet in hopes that you can buy cheap and sell high later. It’s going to take more than a good showing at the Olympics to get Nike’s revenue up and firing on all cylinders like their shareholders have been accustomed to in recent history.

Whether Nike’s stock value stays hovering around where it is now or eventually jumps back up to those 2021 levels, at the end of the day, the brand is always going to be a multi-billion dollar business packed with an arsenal of many of the world’s greatest athletes and most revered sneaker designs of all time. Their numbers might be down, but they’re still raking in more money than any other athletic brand, by far. Yes, brands like On, Hoka, New Balance and Lululemon are making a dent in Nike’s market share, but in 2022, the Swoosh still made more money than adidas, ASICS, and New Balance combined. Despite what all the media coverage surrounding Nike’s recent financial woes might have you believe, the Swoosh aren't going anywhere any time soon.